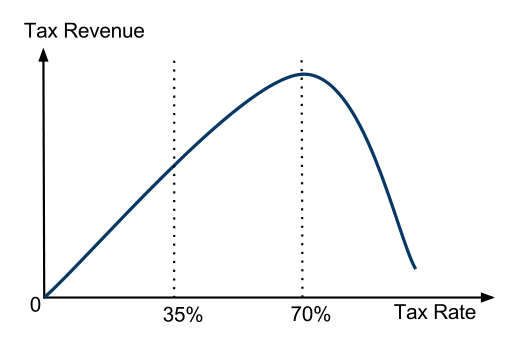

One of the myths that the Cato Institute and the right wing in general likes to push is that taxes are too high in the United States. That we’re on the wrong side of the Laffer Curve. Have you heard of the Laffer Curve? Pardon me while I do a quick explanation.

The theory is based on the idea that if people are taxed at 100% of their income, they won’t work any more than required because they don’t see any additional benefit to their work. Because of that, tax revenue is $0. If you lower the tax rate, then people have some incentive, and tax revenue goes up significantly.

If not used properly, the logic leads to the absurd proposition that the government lowers the tax rate to 0%, then government revenue is maximized. This is obviously not true either. Where the tipping point is can’t be determined exactly, but the best current research puts the optimal (for government revenue) tax rate at somewhere between 60% and 80%. If tax rates are lower than that, lowering them even more results in less revenue to pay for government programs.

This argument was actually made and a big part of pushing through the Bush tax cuts in the early part of the last decade. If we cut our tax rate, we’ll actually have more tax revenue because it will spur the economy so much that people will be working hard and making so much more money that the taxes on that extra growth will make up for the money we would have gotten in higher taxes.

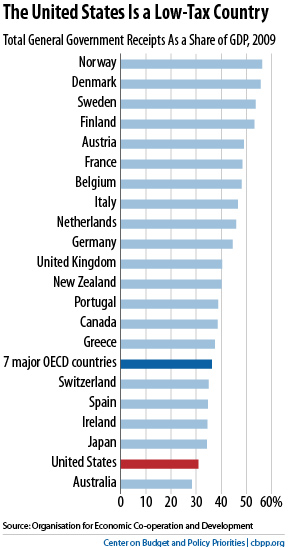

The argument didn’t hold water then, and it doesn’t now. That’s because effective tax rates were well on the left side of that curve, and are even more on the left side of it now. Sometimes in debates, Republicans put out scare figures that we have the highest taxes in the world. It’s just not true. The United States is a low tax country already. We’re not a tax haven, like the Grand Caymans, but taxes are pretty damn low.

As a share of GDP, we’re near the bottom of industrialized countries in total taxes:

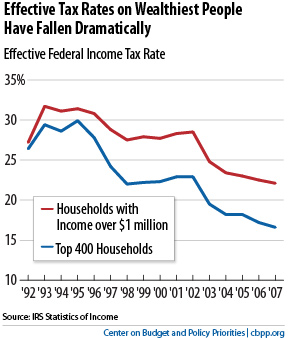

The taxes of the people subject to the highest tax rates are effectively very very low.

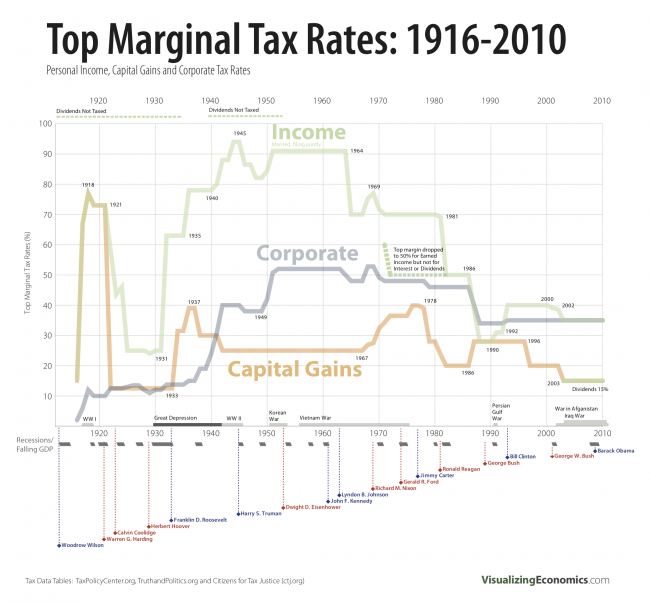

Here’s the nominal tax rates the wealthiest pay. Even the highest rates that a person could pay on a part of their income are lower than at any time since the 1930s.

I’m not arguing here that rich people don’t pay their fair share. That’s for another rant. The point of this is that those rates are way to the left of the peak of the Laffer Curve. Now there’s possibly an argument that rich people will spur more economic activity with the money than the government would, but I don’t think that’s proven.

The next time a Republican tells you taxes are too high, ask them some questions. Ask them to define too high. Ask them what the criteria are for too high. Ask them what the economic goal is for lowering taxes. Because it looks to me like our taxes are pretty lenient.

Discover more from King Rat

Subscribe to get the latest posts sent to your email.

I don’t agree with this post. What exactly is the “best current research”?

I don’t know any research that puts the revenue maximizing rate at 80%. The highest I have seen from any economic researcher is 69% by Emmanuel Saez. Others, such as Lawrence Lindsay and Martin Feldstein, have put it much lower. Plus, the revenue maximizing rate is much lower for the wealthy. This is because the wealthy respond more to changes in tax rates.

The research that studies only wealthy taxpayers finds the rate ranging from 34% to 56% (there have been four studies on this topic, and this is the range of the findings). Therefore, there is no reason to assume that we are on the left side of the laffer curve, at least for wealthy taxpayers.

I don’t agree with this post. What exactly is the “best current research”?

I don’t know any research that puts the revenue maximizing rate at 80%. The highest I have seen from any economic researcher is 69% by Emmanuel Saez. Others, such as Lawrence Lindsay and Martin Feldstein, have put it much lower. Plus, the revenue maximizing rate is much lower for the wealthy. This is because the wealthy respond more to changes in tax rates.

The research that studies only wealthy taxpayers finds the rate ranging from 34% to 56% (there have been four studies on this topic, and this is the range of the findings). Therefore, there is no reason to assume that we are on the left side of the laffer curve, at least for wealthy taxpayers.

I also don’t know why other countries having higher taxes is a good reason for us to have higher taxes. Why are other countries better?

Perhaps there is a reason that we have had faster economic growth than high-tax European welfare states over the past 30 years. More economically successful nations typically have lower taxes. Historically, America has been economically successful. Lower taxes have had something to do with this.